Therefore, it is essential to optimize your inventory management by utilizing methods similar to demand forecasting, stock tracking, reorder point calculation, and stock turnover ratio evaluation. These techniques might help you balance your inventory levels, scale back your holding costs, and avoid overstocking or understocking. These oblique prices are often identified as operating bills and are deducted out of your gross revenue to get your net income. The COGS is deducted from your business revenue to determine the gross profit, which is then used to calculate taxable income. This deduction is typically reported on IRS Kind 1040, Schedule C for sole proprietors and single-member LLCs, the place it is particularly accounted for in the section detailing earnings and expenses.

- To illustrate the gross profit method we’ll assume that ABC Company needs to estimate the cost of its ending inventory on June 30, 2024.

- Fastened costs are those that don’t change with the level of output, similar to hire and salaries.

- With FIFO we assign the first value of $85 to be the cost of goods sold.

These bills aren’t immediately tied to the production of products or companies but are necessary to run the company efficiently. Frequent examples of working expenses include salaries and wages of non-production employees cost of sales on income statement, lease, utilities, advertising, administrative costs, analysis and improvement expenses, and depreciation. In product-based businesses, Price of Sales or Value of Goods Sold (COGS) contains the prices of buying or producing the gadgets that the corporate sells.

Video Explanation Of Price Of Goods Bought

This will provide the e-commerce website with the precise value of goods sold for its business. To find the COGS, a company should discover the worth of its stock at the beginning of the 12 months, which is the value of stock at the finish of the earlier year. This formula reveals the price of products produced and offered over the year. Now that we understand the fundamentals and associated factors of the worth of sales calculator, let us apply the theoretical information to sensible application by way of the examples below.

Cogs Vs Working Expenses: What Is The Difference?

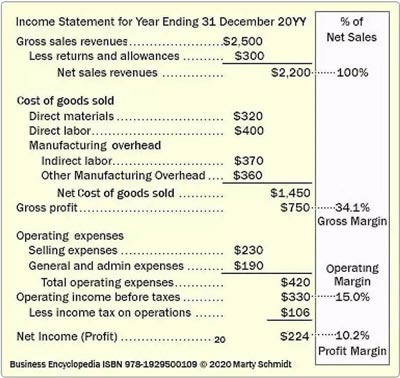

The cost of gross sales consists of direct costs corresponding to materials, labor, and overhead, in addition to indirect prices such as advertising, distribution, and administration. The decrease the value of gross sales, the upper the gross revenue margin, which indicates how efficiently a enterprise can generate revenue from its gross sales. One of crucial features of running a successful business is managing and controlling the value of sales. The price of sales, also known as the price of items offered (COGS), is the direct cost of manufacturing or purchasing the products or companies which are offered to customers. The price of gross sales is deducted from the income to calculate the gross profit, which is a measure of how effectively a enterprise generates revenue from its core operations.

Hence, net sales are the metrics normally employed for decision-making purposes for the enterprise. Gross gross sales and internet gross sales might seem comparable and are usually confused with one another. Internet sales are derived from product sales, is used while analyzing the quality and amount of a company’s sales. Allowances are often due to transporting problems, making the enterprise evaluation its storage methods or delivery tactics. Small businesses offering reductions could lower or improve their discount phrases to become extra competitive within their business. Some small companies normally do not present any transparency within the space of internet sales.

Comparing Cogs To Sales Ratios

Those three factors reduce the gross sales number after the gross sales are made, and thus show up in a while the steadiness sheet. Companies that enable gross sales returns must provide a refund to the customer. A sales return is usually accounted for both as a rise to a gross sales return and allowances contra-account to sales revenue or as a direct decrease in gross sales revenue. Some companies could not have any prices that can require a net gross sales calculation. Sales returns, allowances, and discounts are the three main costs that can affect web gross sales. All three costs generally have to be expensed after an organization books revenue.

Examples of non-operating gadgets are curiosity earnings, interest expense, gains or losses from the sale of assets, impairment expenses, and so on. Non-operating items may distort the price of sales and the gross revenue margin, because they don’t seem to be a part of the worth of producing income. Therefore, you will need to exclude or separate the non-operating objects from the price of gross sales and the gross revenue margin when analyzing the business performance. For instance, if a business sells a few of its gear and recognizes a gain, this gain shouldn’t be included in the value of gross sales, as a result of it is not associated to the manufacturing or sale of the services or products.

Equally, for a corporation (or its franchisees) within the business of offering companies, income from primary activities refers again to the revenue or fees earned in trade for providing these providers. While different numbers similar to gross revenue and gross profit are additionally essential for various causes, net revenue is the bottom-line quantity that traders and banks want to see. Earnings per share may additionally be calculated by dividing the entire variety of shares from the net revenue.

The IRS requires companies that produce, purchase, or promote merchandise for revenue to calculate the value of their inventory. Depending on the business’s dimension, kind of enterprise license, and stock valuation, the IRS might require a particular inventory costing method. Nonetheless, once a business chooses a costing methodology, it should stay consistent with that technique yr over yr. Consistency helps businesses stay compliant with typically accepted accounting ideas (GAAP). Often financial statements check with the balance sheet, income assertion, statement of comprehensive earnings, statement https://www.kelleysbookkeeping.com/ of money flows, and assertion of stockholders’ fairness.